Partnering with A+ Rated Carriers — Pacific Life • Nationwide • Allianz • TransAmerica

LIFE INSURANCE RE-IMAGINED — PROTECTION, GROWTH & fREEDOM ALL IN ONE PLAN

Discover smarter life-insurance strategies that protect your family today and build tax-free wealth for tomorrow. From traditional Whole Life coverage to advanced Indexed Universal Life (IUL) — I'll help you find the right fit for your goals and budget.

Retire With Confidence — Guaranteed Income for Life

Grow and protect your savings, minimize taxes, and enjoy the retirement lifestyle you’ve worked hard to build — without market stress.

all life insurance isn't created equal

TYPE

OVERVIEW

BEST FOR

Term Life

Affordable coverage for 10-30 years. No cash value.

Temporary protection & income retirement.

Whole Life

Lifetime protection, fixed premiums, and guaranteed cash-value growth.

Families seeking long-term guarantees and simplicity.

Indexed Universal Life (IUL)

Flexible premiums, tax-free growth tied to the market - with zero losses.

Professionals, parents, and business owners who want safety + growth.

The LIFE INSURANCE STRATEGY That PROTECTS YOUR FAMILY- AND BUILDS WEALTH

Life insurance shouldn't be just a bill. When structured the right way, it becomes a powerful financial tool-protecting your family today while building cash value you can use for college, emergencies, retirement, or legacy.

With a properly designed Whole Life or Indexed Universal Life (IUL) policy, you can:

Protect your family for life

Grow cash value tax-advantaged

Avoid market losses with IUL

Access living benefits while you're alive

Leave a tax-free legacy for your loved ones

WHOLE LIFE VS. INDEXED UNIVERSAL LIFE (IUL)

Feature

Whole Life

Indexed Universal Life (IUL)

Growth Type

Guaranteed fixed growth

Index-linked growth (higher potential, capped)

Market Upside Potential

None

Yes- participates in market gains (up to a cap)

Market Loss Protection

Yes

Yes - 0% downside floor

Premium Flexibility

Fixed premiums

Flexible premiums

Cash Value Access (Tax-Advantaged)

Yes

Yes

Long-Term Growth Potential

Moderate

High

Ideal For

Stability & long-term guarantees

Flexibility & higher growth

Not sure which option fits your situation best?

That's exactly what I help families figure out - in just a quick, pressure-free call.

The Retirement Solution That Never Runs Out

Retirement isn’t about gambling on the stock market. It’s about having a plan you can count on.

With a properly structured annuity, you can:

Protect your savings from market losses

Grow your money tax-deferred

Turn your nest egg into guaranteed income for life

Leave a legacy for your loved ones

It’s not about chasing risky returns — it’s about building a safe, reliable income stream that lasts as long as you do.

trusted a-rated insurance Carriers

We partner with some of the strongest and most respected financial institutions in America. These carriers represent our top-tier options - known for exceptional financial strength, stability, and long-term reliability.

Through our national network, we have access to 100+ carriers, allowing us to match every client with the right company - whether you prefer premium A-rated carriers or need flexible approval options.

Pacific Life

COMDEX: 96/100 (Top Tier)

A.M. Best: A+ (Superior)

Over 150 Years of proven Financial Strength.

Allianz

COMDEX: 94-96 (Top 5%)

A.M. Best Rating: A+ (Superior)

Global Leader in IULs & Indexed Annuities

Transamerica

COMDEX: 81/100

A.M. Best: A (Excellent)

Backed by Aegon - one of the worlds's largest financial organizations

Nationwide

COMDEX: 90/100

A.M. Best: A+ (Superior)

Trusted national financial institution for 100+ years

National Life Group

COMDEX: 90/100

A.M. Best: A+ (Superior)

Top U.S. life insurance group recognized for reliability

What is a COMDEX Score?

COMDEX is a percentile ranking (1-100) that combines ratings from the major independent rating agencies - A.M. Best, Moody's, Standard & Poor's, and Fitch - into one simple score.

~ Higher score = stronger company

~ 90-100 = top-tier financial strength and claims-paying ability

We only partner with carriers rated A or higher - the companies trusted by banks, hospitals, Fortune 500 firms, and major financial institutions.

real clients, Real protection, Real Results

Families from every background are getting clarity, protection, and real financial peace of mind - no confusion, no pressure, just honest solutions.

⭐ ⭐ ⭐ ⭐ ⭐

"I just wanted simple life insurance for my family - now I have protection and a tax-free retirement plan. The breakdown was so easy to understand, and I finally feel confident about my future."

Tasha W. — Parent & Educator

⭐ ⭐ ⭐ ⭐ ⭐

Jason H. — Business Owner

⭐ ⭐ ⭐ ⭐ ⭐

“I was turned down before because of health reasons. Elgie found a carrier that approved me at a great rate! Having over 100 carrier options really makes a difference."

Angela S. — Nurse & Mother of Two

⭐ ⭐ ⭐ ⭐ ⭐

“Elgie explained the difference between Whole Life and IUL in minutes. I've already built a cash value I can use later - it's like my own private bank."

David L. — Engineer, Age 34

⭐ ⭐ ⭐ ⭐ ⭐

“We wanted something better than our 401(k). Now our plan grows tax-free, protected from losses, and we can pull from it without penalties. Wish we knew this sooner!"

The Henderson Family — Married Couple, Mid-40s

⭐ ⭐ ⭐ ⭐ ⭐

“As a dad of three, I didn't want to leave my family guessing. Elgie helped me build a plan that protects us today and grows tax-free for the future. It feels good to finally have something solid in place"

— Brian M., FL

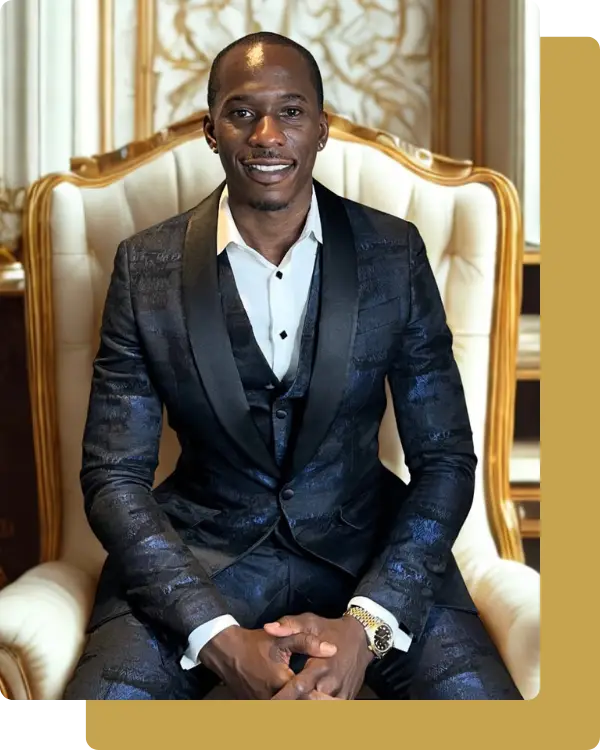

Meet your licensed financial professional

I'm a licensed financial professional who specializes in helping families, professionals, and business owners protect what matters, grow their wealth, and access it tax-free — without market risk.

With access to 100+ top-rated insurance carriers nationwide, I create personalized strategies built around your goals — whether you want lifetime protection, cash-value growth, living benefits, or a tax-free retirement plan.

My mission is simple:

to educate, empower, and guide families toward real financial security and a legacy they can pass on with confidence.

Frequently Asked Questions

What's the difference between Whole Life and IUL?

Whole Life offers fixed premiums, guaranteed growth, and predictable cash value.

IUL (Indexed Universal Life) offers more flexibility with the potential for higher growth tied to market performance — while protecting you from market losses with a zero-loss floor.

Both provide lifelong protection and can build tax-advantaged cash value when structured properly.

Are life-insurance benefits really tax-free?

Yes. Life-insurance death benefits are generally paid income tax-free to your beneficiaries.

Additionally, cash value can often be accessed through policy loans and withdrawals that may be tax-advantaged when structured correctly.

What's a COMDEX score and why does it matter?

The COMDEX score ranks insurance companies on a scale of 1–100 by averaging all major rating agencies (AM Best, Moody’s, S&P, and Fitch).

The higher the score, the stronger the company’s financial stability and ability to pay claims.

I work with carriers that meet high financial standards for safety, reliability, and long-term performance.

Can I qualify even if I’ve been denied before?

In many cases, yes. With access to over 100 carriers, there is often an option available based on your health, age, and financial situation — even if you’ve been declined elsewhere.

What if I already have life insurance?

That’s great. We’ll review your current policy at no cost to ensure it still aligns with your goals.

Many clients discover they can upgrade to strategies that offer living benefits, tax-advantaged access, and stronger long-term growth.

Will I still have access to my money?

Yes. Your cash value remains accessible. Many clients use tax-advantaged policy loans for:

College expenses

Investments

Business opportunities

Emergencies

— while their policy continues to grow.

Ready to Protect Your family's future?

Don’t leave your family's protection to chance. Get your Free Life Insurance Blueprint today and discover how to secure lifetime coverage, build tax-advantaged cash value, and protect your legacy.